Wealth Management

Wealth Management, sometimes people can be misled by this term because they think it is something related to one’s own wealth and equity measure but in a broad context it is not.

Wealth Management, sometimes people can be misled by this term because they think it is something related to one’s own wealth and equity measure but in a broad context it is not.

Wealth management is much more than just an investments or a short tem service; it is a vast and comprehensive view of a person’s or a firm’seconomical and financial life. Managing someone’s wealth from more than one aspect requires an understanding of different financial perspectives, services, and products, schemes and belongings.

Wealth management starts from the time when all of these are taken care of. Investing is just another part of it. Many people used to believe that wealth management is for the rich and higher classes but the trend has changed in current millennium. Wealth management is generally considered to be a service that rich people avail or someone who has a vast liquidity of cash. But that is a thing of the past. Today, wealth management is of as much importance to the middle class or to any person who deals in the investment sector as it is to the rich and firms. Maybe, much more.

You can think that you don’t have a lot liquidated cash or wealth but even then, whatever you have it needs to be managed,protected and built further, in an appropriate way to get the maximum benefits,the amount of wealth you have doesn't matter, what matters is how well you will be able to manage it in coming market order. Good management of your wealth will lead you to hold onto what you have and build upon it as well.

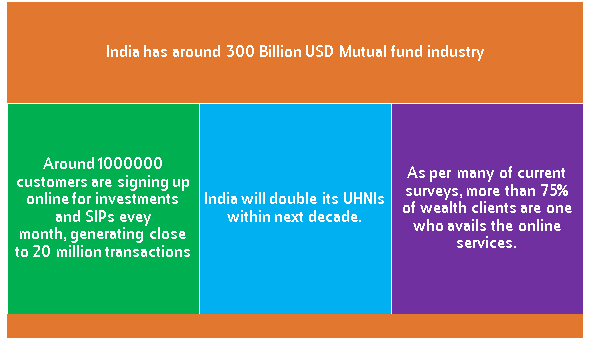

Well there are several importance of it but to get more precise let’s take a look into the context of India.

8 percent of the total population in India represent 45 percent of the total wealth, only 20 percent wealthy families take advice from wealth managers. However, this number is growing steadily as more and more client seeks advice for:

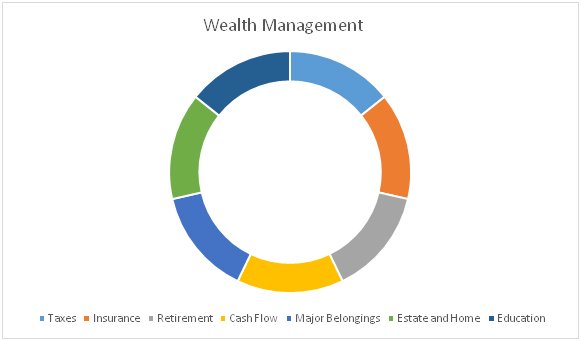

As per the above graph, you can figure out what we take into account for an appropriate wealth management.

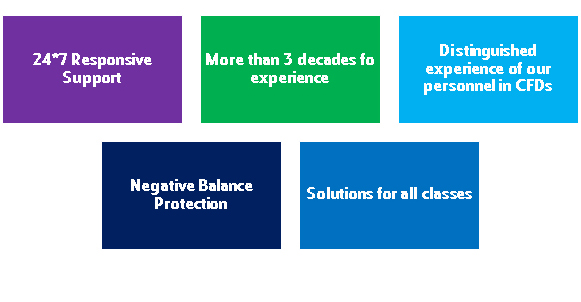

Sanyam Investing offers traders a complete package of leading trading conditions and support.

Trading CFDs involves significant risk of loss